Consumer Confidence Fell in February Amid Concerns About the Future

The recent jump in the prices of household staples, like eggs, and the potential impact of tariffs worried consumers.

The Conference Board’s monthly consumer confidence index fell to 98.3 in February from an upwardly revised 105.3 in January.

It marked the largest monthly decline since August 2021, according to Stephanie Guichard, senior economist, global indicators, at The Conference Board.

“This is the third consecutive month on month decline, bringing the index to the bottom of the range that has prevailed since 2022,” she said.

Of the five components the index tracks, only consumers’ views of present business conditions improved, and only slightly.

“Views of current labor market conditions weakened. Consumers became pessimistic about future business conditions and less optimistic about future income. Pessimism about future employment prospects worsened and reached a ten-month high,” said Guichard.

Consumers of all ages felt the drop in confidence, though it was steepest for consumers between 35 and 55 years old.

It was felt across all income groups, except households earning less than $15,000 a year and those earning between $100,000 to $125,000.

The average 12-month inflation expectations rose to 6 percent from 5 percent.

“This increase likely reflected a mix of factors, including sticky inflation but also the recent jump in prices of key household staples like eggs and the expected impact of tariffs,” said Guichard.

In the write-in responses, many consumers continued to mention inflation and prices, but there was a notable shift to other topics.

“There was a sharp increase in the mentions of trade and tariffs, back to a level unseen since 2019. Most notably, comments on the current Administration and its policies dominated the responses,” said Guichard.

The Conference Board’s Present Situation Index, which measures consumers’ current view of business and labor market conditions, fell to 136.5 in February from 139.9 in January.

While consumers’ view of current business conditions improved slightly, they were more pessimistic about the labor market.

The Expectations Index, which measures consumers’ outlook on income, business, and labor market conditions in the near future, fell to 72.9 from 82.2 in January.

Notably, this index fell below 80, which usually signals a recession ahead, for the first time since June 2024, said the Conference Board.

Consumers held more pessimistic outlooks across the board in regard to future business conditions, the labor market, and their income prospects.

Their outlooks on their family’s current and expected financial situation, a measure not included when calculating the Present Situation and Expectations Index, were also more pessimistic.

“Consumers’ Perceived Likelihood of a U.S. Recession over the Next 12 Months” also rose in February to a nine-month high.

Fewer consumers were bullish on the stock market, with 47 percent expecting stock prices to increase over the year ahead, the lowest percentage of consumers since April 2024, down from 54 percent in January.

More consumers expect to see stock prices decline, up to 33 percent from 25 percent in January.

More than half of respondents (52 percent) expect to see higher interest rates over the next 12 months. Fewer expect to see lower rates, down to 24 percent from 27 percent in January.

As for home buying, purchasing plans on a six-month moving average basis continued to recover, said the Conference Board, likely boosted by the “very recent” decline in mortgage rates.

Buying plans for cars and big-ticket items were down, especially in the TV and electronics categories.

Consumers’ plans to purchase services in the months ahead were little changed, but the Conference Board noted a shift in priorities.

Vacation plans continued to trend downward, while consumers prioritized purchasing personal and health care, movies, and live entertainment.

The Consumer Confidence survey results for March are scheduled to be released on March 25.

The Latest

The heist happened in Lebec, California, in 2022 when a Brinks truck was transporting goods from one show in California to another.

The 10-carat fancy purple-pink diamond with potential links to Marie Antoinette headlined the white-glove jewelry auction this week.

The Starboard Cruises SVP discusses who is shopping for jewelry on ships, how much they’re spending, and why brands should get on board.

The Seymour & Evelyn Holtzman Bench Scholarship from Jewelers of America returns for a second year.

The historic signet ring exceeded its estimate at Noonans Mayfair’s jewelry auction this week.

To mark the milestone, the brand is introducing new non-bridal fine jewelry designs for the first time in two decades.

The gemstone is the third most valuable ruby to come out of the Montepuez mine, Gemfields said.

The countdown is on for the JCK Las Vegas Show and JA is pulling out all the stops.

Founder and longtime CEO Ben Smithee will stay with the agency, transitioning into the role of founding partner and strategic advisor.

Associate Editor Natalie Francisco shares 20 of her favorite pieces from the jewelry collections that debuted at Couture.

If you want to attract good salespeople and generate a stream of “sleeping money” for your jewelry store, then you are going to have to pay.

The top lot was a colorless Graff diamond, followed by a Burmese ruby necklace by Marcus & Co.

Gizzi, who has been in the industry since 2001, is now Jewelers of America’s senior vice president of corporate affairs.

Luca de Meo, a 30-year veteran of the auto industry, will succeed longtime CEO François-Henri Pinault.

Following visits to Vegas and New York, Botswana’s minerals minister sat down with Michelle Graff to discuss the state of the diamond market.

The “Your Love Has the Perfect Ring” campaign showcases the strength of love and need for inclusivity and representation, the jeweler said.

The former De Beers executive is the jewelry house’s new director of high jewelry for the Americas.

The New York Liberty forward is the first athlete to represent the Brooklyn-based jewelry brand.

Take a bite out of the 14-karat yellow gold “Fruits of Love Pear” earrings featuring peridots, diamond stems, and tsavorite leaves.

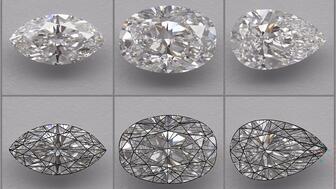

The one-day virtual event will feature speakers from De Beers, GIA, and Gemworld International.

The California-based creative talks jewelry photography in the modern era and tackles FAQs about working with a pro for the first time.

Al Capone’s pocket watch also found a buyer, though it went for less than half of what it did at auction four years ago.

The foundation has also expanded its “Stronger Together” initiative with Jewelers for Children.

Assimon is the auction house’s new chief commercial officer.

The De Beers Group CEO discusses the company’s new “beacon” program, the likelihood diamonds will be exempt from tariffs, and “Origin.”

The Danish jewelry giant hosted its grand opening last weekend, complete with a Pandora pink roulette wheel.

Industry veteran Anoop Mehta is the new chairman and independent director of the IGI board.